Investing in cryptocurrencies can be a lucrative and exciting venture, but it’s important to have a solid strategy in place to maximize your profits. With the volatile nature of the cryptocurrency market, it’s crucial to make informed decisions and take calculated risks. In this article, we will discuss some of the best strategies that can help you maximize your profits in the crypto world.

1. Diversify your portfolio: One of the key strategies for success in crypto trading is diversification. By investing in a variety of cryptocurrencies, you can spread your risk and increase your chances of making profitable trades. Different cryptocurrencies have different levels of volatility and potential for growth, so diversifying your portfolio can help protect you from potential losses.

2. Stay updated with market trends: The cryptocurrency market is constantly evolving, and staying updated with the latest trends is essential for maximizing your profits. Keep an eye on news, market analysis, and expert opinions to identify potential opportunities and make well-informed decisions. Being aware of market trends can help you spot potential entry and exit points for trades.

3. Set clear goals and stick to your strategy: Before entering the crypto market, it’s crucial to set clear goals and develop a trading strategy. Determine your risk tolerance, profit targets, and timeframes for holding your investments. Once you have defined your strategy, stick to it and avoid making impulsive decisions based on short-term market fluctuations. Emotions can cloud judgment and lead to poor trading decisions.

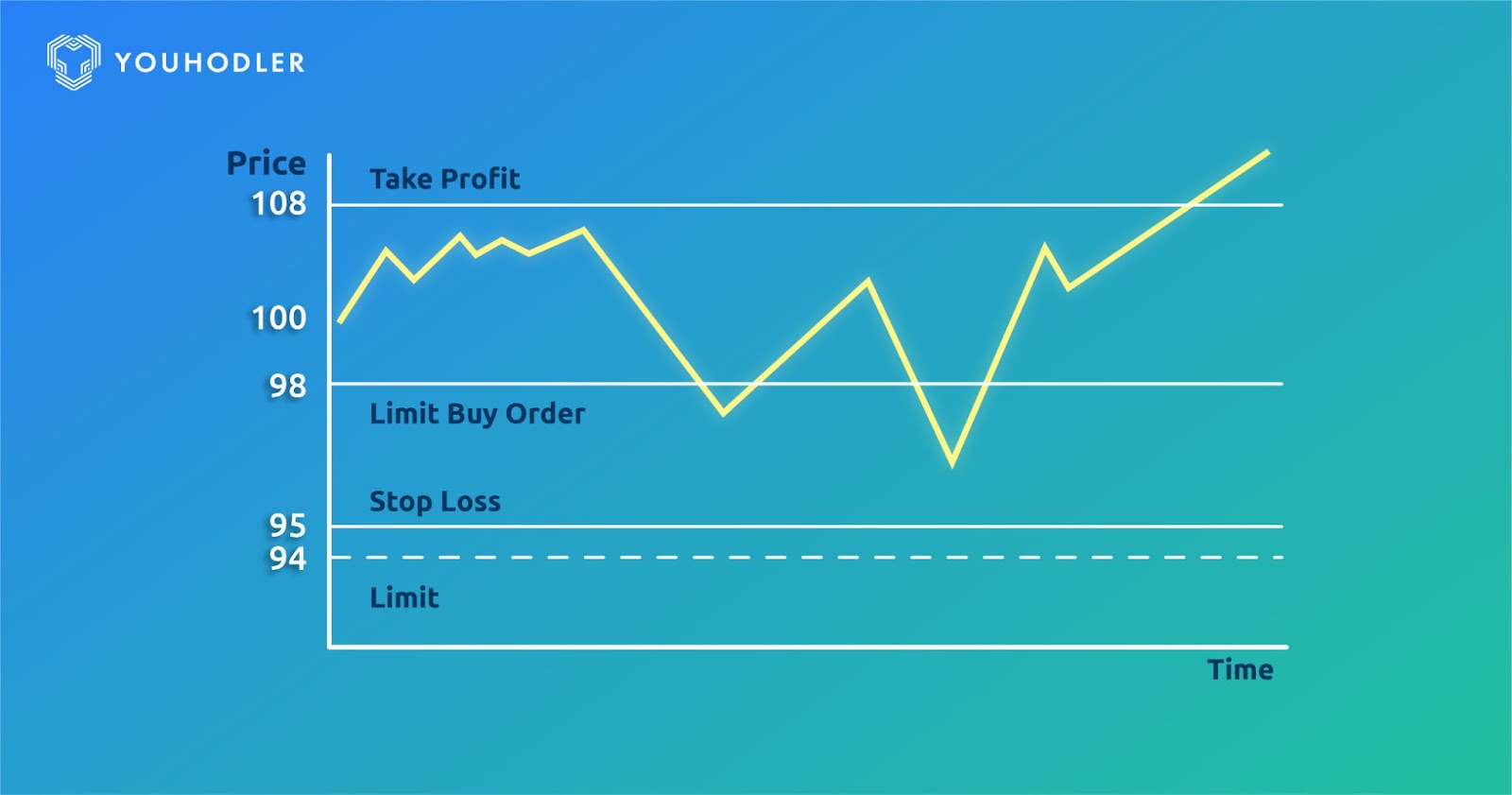

4. Use stop-loss orders: To protect your investments from significant losses, it’s advisable to use stop-loss orders. A stop-loss order is a predetermined price at which you will sell a cryptocurrency to limit your losses. By setting a stop-loss order, you can automatically sell your cryptocurrencies if the market moves against you, preventing further losses.

5. Consider long-term investments: While day trading can be profitable, it’s also important to consider long-term investments in cryptocurrencies. Some cryptocurrencies have shown exponential growth over a longer period, and if you believe in the long-term potential of a particular cryptocurrency, holding onto it can lead to significant profits. However, thorough research is necessary before making any long-term investment decisions.

In conclusion, maximizing your profits in the world of cryptocurrencies requires a combination of careful planning, research, and disciplined trading. By diversifying your portfolio, staying updated with market trends, setting clear goals, using stop-loss orders, and considering long-term investments, you can increase your chances of success and maximize your profits in the crypto market.

Setting Clear Goals: The Path to Success

Setting clear goals is a crucial step in maximizing your profits in crypto. Whether you are a seasoned investor or a beginner, having a clear vision of what you want to achieve is essential for success.

When setting goals, it’s important to be specific. Instead of saying, “I want to make more money in crypto,” try setting a specific target, such as, “I want to earn a 20% return on my investment within six months.” This will give you a clear direction and allow you to create a plan to achieve your goal.

In addition to being specific, goals should also be measurable. This means that you should be able to track your progress and evaluate whether you are heading in the right direction. For example, you can set milestones along the way, such as earning a certain percentage of your target goal each month.

Furthermore, it’s important to set realistic goals. While it’s great to have big aspirations, setting goals that are too far-fetched may set you up for disappointment. Take into consideration your current financial situation, knowledge of the market, and the time and effort you can commit to crypto trading.

Tip: It’s also beneficial to set short-term and long-term goals. Short-term goals can help keep you motivated and provide smaller accomplishments along the way, while long-term goals give you a bigger picture of what you want to achieve in the crypto market.

Lastly, don’t forget to review and adjust your goals regularly. The crypto market is constantly changing, and what may have been a realistic goal a few months ago may no longer be achievable. Stay flexible and be willing to modify your goals as needed.

In conclusion, setting clear goals is the key to success in maximizing your profits in crypto. Be specific, measurable, and realistic, and don’t forget to review and adjust your goals regularly. With a clear vision and a solid plan, you’ll be on the right path to achieving your financial goals in the crypto market.

Diversification: Spreading Your Risk and Increasing Profit Potential

When it comes to investing in crypto, one of the key strategies for maximizing your profits is diversification. Diversification involves spreading your investments across different crypto assets, which helps to minimize your risk while increasing your profit potential.

By diversifying your portfolio, you reduce the impact of any single asset’s performance on your overall investment. This means that even if one asset experiences a decline in value, the impact on your entire portfolio is mitigated by the performance of your other investments.

Additionally, diversification allows you to take advantage of the potential growth of multiple crypto assets. While some assets may experience stagnant or declining growth, others may see significant price increases. By having exposure to a variety of assets, you increase your chances of capturing those high-growth opportunities.

However, it’s important to note that diversification does not guarantee profit or protect against losses. It’s crucial to conduct thorough research and analysis to select a diversified portfolio of crypto assets that align with your investment goals, risk tolerance, and time horizon.

Furthermore, it’s important to regularly monitor and rebalance your portfolio to maintain the desired level of diversification. As the crypto market is highly dynamic and volatile, the performance of different assets may vary over time. Rebalancing involves selling or buying assets to maintain the desired asset allocation, ensuring that your portfolio remains diversified.

In conclusion, diversification is a crucial strategy for maximizing your profits in crypto. By spreading your risk across different assets, you can reduce the impact of any single asset’s performance and increase your profit potential. However, it’s important to conduct thorough research and regularly monitor your portfolio to maintain the desired level of diversification.

Timing the Market: Capitalizing on Crypto Volatility

One of the key strategies for maximizing profits in the crypto market is to understand and take advantage of market volatility. Crypto markets are known for their high volatility, which means that prices can fluctuate wildly in a short period of time.

To capitalize on this volatility, it’s important to have a good understanding of market trends and to be able to accurately predict price movements. This requires analyzing historical data, staying up-to-date with news and events that may affect the market, and using technical analysis to identify patterns and trends.

Timing the market is crucial when it comes to crypto trading. Buying low and selling high is the goal, but it can be challenging to accurately time your trades. It’s important to have a clear entry and exit strategy in place, and to stick to it even when emotions and market sentiments are high.

One common approach to timing the market is to use technical indicators such as moving averages, MACD, and RSI to identify potential buying and selling opportunities. These indicators can help you identify when a market is overbought or oversold, and therefore, when it may be a good time to enter or exit a trade.

Another strategy is to take advantage of market trends and momentum. If a cryptocurrency is experiencing a strong uptrend, it may be a good time to buy and hold for the long term. On the other hand, if a cryptocurrency is experiencing a strong downtrend, it may be a good time to sell and cut your losses.

While timing the market can be challenging, it’s important to remember that no strategy is foolproof. Crypto markets are highly unpredictable and can be subject to sudden and unexpected price swings. It’s important to always do your own research, diversify your portfolio, and only invest what you can afford to lose.

In summary, timing the market and capitalizing on crypto volatility can be a profitable strategy if done correctly. By staying informed, using technical analysis, and having a clear strategy in place, you can increase your chances of maximizing profits in the crypto market.

Research and Analysis: Finding Hidden Gems

Investing in cryptocurrency can be a highly profitable venture, but it requires careful research and analysis to identify the best opportunities. With thousands of cryptocurrencies to choose from, finding hidden gems can be a daunting task. However, by following a strategic approach to research and analysis, investors can uncover promising investments.

Due Diligence

Before investing in any cryptocurrency, it is crucial to conduct thorough due diligence. This involves researching the project behind the cryptocurrency, analyzing the team members’ backgrounds, examining the technology and its potential for adoption, and evaluating the overall market sentiment. By scrutinizing these factors, investors can gain insights into the project’s viability and potential for long-term success.

Market Research

Understanding the market dynamics is vital in identifying hidden gems. Investors should analyze the supply and demand dynamics, market trends, and the competitive landscape. By conducting comprehensive market research, investors can identify cryptocurrencies with unique features or competitive advantages that could potentially drive their value up.

Technical Analysis

Technical analysis involves studying price charts and indicators to forecast future price movements. Investors can use various technical analysis tools and techniques, such as moving averages, support and resistance levels, and momentum indicators, to identify entry and exit points for investments. This analysis helps investors make informed decisions based on historical price patterns and market trends.

Fundamental Analysis

Fundamental analysis focuses on evaluating the intrinsic value of a cryptocurrency. Investors assess factors such as the project’s underlying technology, its use case, the team’s expertise, partnerships, and roadmap. By analyzing these fundamental factors, investors can identify undervalued cryptocurrencies with strong growth potential.

Community Engagement

Engaging with the cryptocurrency community can provide valuable insights and information. Investors can join online forums, social media groups, and attend conferences to stay updated on the latest developments and trends. By actively participating in the community, investors can gain access to insider knowledge and potential investment opportunities.

In conclusion, conducting thorough research and analysis is key to finding hidden gems in the cryptocurrency market. By performing due diligence, analyzing market dynamics, using technical and fundamental analysis, and engaging with the community, investors can identify cryptocurrencies with the potential for significant profits.

Risk Management: Protecting Your Profits

When it comes to investing in crypto, one of the most important things you can do is manage your risk effectively. Crypto markets are known for their volatility, which means that prices can fluctuate wildly in a short period of time. This volatility can lead to significant gains, but it can also result in substantial losses if you’re not careful.

Here are some strategies you can use to protect your profits and minimize your risk:

| Diversify Your Portfolio | Investing in a diverse range of cryptocurrencies can help ensure that your profits are not dependent on the performance of a single coin. By spreading your investments across different projects, you can reduce the impact of any one investment performing poorly. |

| Set Stop-Loss Orders | A stop-loss order is an instruction to sell a coin when it reaches a certain price. By setting stop-loss orders, you can automatically sell your holdings if the price drops below a specific threshold. This can help limit your losses and protect your profits. |

| Use Take-Profit Orders | Similar to stop-loss orders, take-profit orders allow you to automatically sell a coin when it reaches a certain price. This can help you lock in your profits and prevent a sudden reversal in price from eroding your gains. |

| Monitor Market News and Trends | Staying up-to-date with the latest news and trends in the crypto market can help you make more informed investment decisions. By keeping a close eye on market developments, you can react quickly to any changes that may impact your profits. |

| Set Realistic Expectations | While crypto investing can be highly profitable, it’s essential to set realistic expectations and not let greed drive your decision-making. Understanding the risks involved and being prepared for both gains and losses can help protect your profits in the long run. |

Implementing these risk management strategies can help safeguard your profits and ensure you have a more successful crypto investing journey. Remember, in the volatile world of cryptocurrency, protecting your profits is just as important as maximizing them.

Utilizing Tools and Technology: Gaining an Edge

In the world of cryptocurrency trading, staying ahead of the competition is crucial. Utilizing the right tools and technology can give you a significant edge and maximize your profits. Here are some strategies to help you gain an advantage:

1. Real-time Data Analysis

Access to real-time data is essential for making informed decisions in the volatile world of cryptocurrency markets. By utilizing tools that provide up-to-the-minute price charts, market trends, and trading volumes, you can analyze the market with precision and act accordingly. This can help you identify patterns and opportunities that others may miss.

2. Automated Trading Bots

Automated trading bots can be powerful tools to maximize your profits. These bots are designed to execute trades based on predefined parameters and algorithms. By setting specific entry and exit points, as well as stop-loss levels, you can ensure that your trades are executed without emotion and according to your strategy. This can help you take advantage of market fluctuations and minimize human error.

Note: While automated trading bots can be helpful, it’s important to choose a reputable and trustworthy provider and thoroughly test the strategy before committing real funds.

3. Price Alerts and Notifications

Price alerts and notifications can help you stay updated on market movements and seize opportunities quickly. By setting price alerts for specific cryptocurrencies or price thresholds, you can receive instant notifications via email or mobile apps. This allows you to react promptly to market changes, whether it’s to buy, sell, or adjust your strategy.

Remember: Timing is critical in cryptocurrency trading, so being notified of price movements in real-time is crucial.

In conclusion, harnessing the power of tools and technology can give you a competitive edge in the fast-paced cryptocurrency market. By utilizing real-time data analysis, automated trading bots, and price alerts, you can increase your chances of maximizing profits and staying ahead of the game. But always remember to stay informed, test your strategies, and exercise caution when choosing and implementing these tools.

Staying Informed: Keeping Up with Market Trends

In order to maximize your profits in the crypto market, it is crucial to stay informed and keep up with the ever-changing market trends. Here are some strategies to help you stay updated:

1. Follow credible news sources:

Stay connected with reputable news sources that cover cryptocurrency and blockchain technology. This will provide you with up-to-date information on market trends, new regulations, and industry developments.

2. Engage in online communities and forums:

Join online communities and forums where crypto enthusiasts and experts share their knowledge and insights. Participating in these communities can offer valuable discussions and enable you to learn from experienced traders and investors.

3. Utilize social media platforms:

Follow influential figures and crypto-related accounts on social media platforms such as Twitter, LinkedIn, and Reddit. These platforms are often used for sharing news, insights, and market analysis, allowing you to stay informed in real-time.

4. Subscribe to newsletters and podcasts:

Subscribe to newsletters and podcasts that specifically focus on the crypto market. These resources provide in-depth analysis, expert opinions, and insider information that can give you an edge in making informed trading decisions.

5. Analyze market data and charts:

Regularly analyze market data and charts to identify patterns and trends. Utilize technical analysis tools and indicators to make projections and informed trading decisions based on historical data.

In conclusion, staying informed and keeping up with market trends is vital for maximizing your profits in the crypto market. By following credible news sources, engaging in online communities, utilizing social media platforms, subscribing to relevant newsletters and podcasts, and analyzing market data, you can stay ahead and make informed trading decisions.

Question-answer: How to take profits in crypto

What are some strategies for maximizing profits in crypto?

One strategy is to diversify your investments across different cryptocurrencies. Another strategy is to stay informed about the market trends and to buy low and sell high.

How can I effectively diversify my crypto investments?

One way to diversify your investments is to allocate your funds across different cryptocurrencies with different market caps and use cases. Additionally, you can invest in different sectors of the crypto market, such as DeFi, NFTs, or privacy coins.

What are some tips for staying informed about the crypto market?

Some tips for staying informed about the crypto market include following reputable news sources and influencers in the industry, joining crypto communities and forums, and regularly analyzing market data and charts.

Is it better to hold onto my crypto for the long term or to actively trade?

The answer to this question depends on your personal investment goals and risk tolerance. Holding onto crypto for the long term can be a strategy for potential long-term gains, while active trading can provide opportunities for short-term profits but also carry higher risks.

What are some factors to consider when deciding when to buy or sell crypto?

When deciding when to buy or sell crypto, you should consider factors such as market trends, historical price data, project fundamentals, news and events, and your own risk tolerance and investment goals.

What are some strategies for maximizing profits in crypto?

There are several strategies that can help maximize profits in crypto. One strategy is to buy low and sell high, taking advantage of price fluctuations. Another strategy is to diversify your portfolio and invest in a variety of cryptocurrencies, which can help spread the risk. Additionally, staying informed and following market trends can help identify potential investment opportunities.

Is it possible to make consistent profits in the crypto market?

Making consistent profits in the crypto market is challenging due to its volatility, but it is possible with the right strategies. Some traders use technical analysis and chart patterns to predict market movements and make informed trading decisions. Others focus on long-term investing and holding onto cryptocurrencies that have strong potential. It’s important to note that the crypto market can be unpredictable, so it’s crucial to do thorough research and manage risks.